No point in food price measures without targeting small stores, Which? warns

UK ministers’ efforts to reduce soaring food shopping bills “won’t touch the sides” without measures to make small grocery stores more affordable for low-income households, the chancellor has been warned.

Which?, the consumer group, has written to Jeremy Hunt over concerns that a blanket approach to lowering supermarket bills will not address the problem of accessibility to affordable food, after reports that ministers are considering a voluntary price cap scheme.

A study comparing the availability of 29 everyday items during visits to large and smaller stores by Which? found that budget-range items were available less than 1% of the time at convenience branches such as Tesco Express and Sainsbury’s Local. By comparison, the study of 123 Asda, Morrisons, Sainsbury’s and Tesco stores found that on average the biggest shops carried 87% of the value items.

Meanwhile, a recent survey by the organisation found that two-thirds of low-income families relied on these stores. A shopper buying groceries each week at a Tesco Express would spend an extra £800 a year compared with at a larger Tesco store or online, Which? found.

In the letter to Hunt, Which?’s director of policy and advocacy, Rocio Concha, said the cost of food was higher for those without access to larger stores and it was unclear whether an intervention such as a price cap would help consumers.

Which? called on the government to push supermarkets to agree to stock a range of budget foods in smaller stores.

Sue Davies, Which?’s head of food policy, said: “The government is right to be looking at how to support people with soaring food costs but unfortunately without addressing the issues hitting shoppers, and particularly those on low incomes relying on expensive convenience stores, these food price measures won’t touch the sides.

“Ministers should prioritise securing commitments from supermarkets to stock a healthy and affordable budget range across their stores, including convenience stores and ensuring pricing is easily comparable so people can see which items offer the best value.”

UK inflation rises to highest level in almost 30 years at 5.4%

Re: UK inflation rises to highest level in almost 30 years at 5.4%

-

dutchman - Site Admin

- Posts: 50566

- Joined: Fri Oct 23, 2009 1:24 am

- Location: Spon End

Re: UK inflation rises to highest level in almost 30 years at 5.4%

Interest rate rise expected after UK inflation shock

Interest rates are expected to rise again after UK inflation remained much higher than expected for the fourth month in a row.

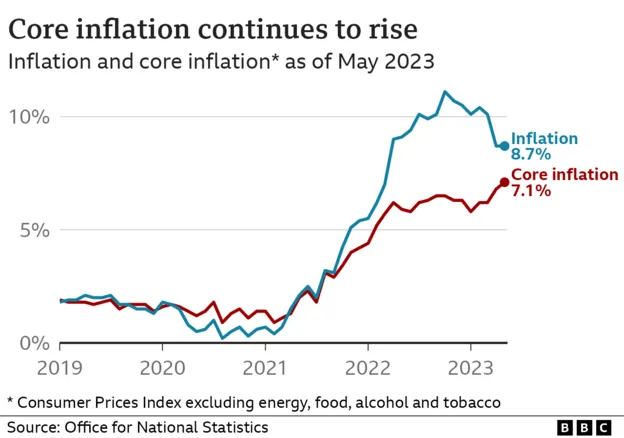

Inflation, which measures the rate of rising prices, stuck at 8.7% in May.

The shock figure was driven by higher prices for flights and second-hand cars but supermarket food prices also continued to rise rapidly.

In a heated exchange at PMQs, Rishi Sunak and Labour leader Keir Starmer clashed over who was to blame.

Sir Keir accused the Conservatives of being to blame for "the mortgage catastrophe". But Prime Minister Mr Sunak hit back, citing "the global macroeconomic situation" and saying it had spent "tens of billions" supporting people with the cost of living.

Interest rates are widely expected to rise by 0.25% to 4.75% on Thursday but some suggest they could now go up to 5%. Rising rates mean homeowners are facing big increases in mortgage payments.

Influential think tank the Institute for Fiscal Studies (IFS) warned higher rates would result in a drop of more than 20% in disposable income for 1.4 million mortgage holders.

Karen Ward, a member of chancellor Jeremy Hunt's economic advisory council, said the Bank had "been too hesitant" in its interest rate rises so far and called on it to "create a recession" to curb soaring prices.

"It's only when companies feel nervous about the future that they will think 'Well, maybe I won't put through that price rise', or workers, when they're a little bit less confident about their job, think 'Oh, I won't push my boss for that higher pay,'" she told the BBC's Today programme.

The Bank is tasked with keeping inflation at 2% but the current inflation rate is four times higher than this. It has been steadily raising interest rates since the end of 2021. This makes it more expensive to borrow money and theoretically encourages people to borrow less and spend less, meaning price rises should ease.

So-called "core" inflation, which strips out volatile factors such as direct energy and food prices, along with alcohol and tobacco prices, continued to rise last month rising at its fastest rate for 31 years.

-

dutchman - Site Admin

- Posts: 50566

- Joined: Fri Oct 23, 2009 1:24 am

- Location: Spon End

Re: UK inflation rises to highest level in almost 30 years at 5.4%

UK inflation slows to 6.8% in July on lower energy prices

Lower gas and electricity costs drove a sharp drop in headline UK inflation in July but underlying price pressures failed to fall as expected, maintaining pressure on the Bank of England to keep interest rates high.

Consumer prices were 6.8 per cent higher in July than a year earlier, with the rate of increase down from 7.9 per cent the previous month, according to data published on Wednesday by the Office for National Statistics. This drop resulted in the lowest inflation rate since February last year.

The headline figure met economists’ expectations and will come as modest relief after wage data on Tuesday was surprisingly strong. But the details suggested Britain had not made progress in solving its inflation problem.

Stripping out food and energy prices, core inflation rose at an unchanged annual rate of 6.9 per cent in July and services prices increased at a faster pace, maintaining pressure on the BoE to keep monetary policy tight in order to restore price stability.

The central bank’s Monetary Policy Committee this month raised interest rates by 0.25 percentage points to a 15-year high of 5.25 per cent. Markets expect a 15th consecutive increase when the nine-member panel meets in September.

Suren Thiru, economics director at the ICAEW accountancy trade body, said: “Although these figures provide reassurance that the inflation tide has turned, this latest drop owes more to lower energy bills, following the reduction in Ofgem’s energy price cap, than to a broader easing of price pressures.”

The lower quarterly energy price cap led to a 15 per cent fall in gas and electricity prices in July, which contributed to an overall 0.4 per cent drop in prices compared with June.

Food prices stabilised in July, rising only 0.1 per cent in the month and bringing the annual rate of food price inflation down from 17.3 per cent to 14.9 per cent.

Market reaction to the data was muted, as it was close to expectations. Sterling edged higher to $1.274 against the dollar, with the yields on gilts barely moving in morning trading. With little movement in the bond markets, the figures are unlikely to move mortgage rates.

But the improvements in energy and food prices were offset by signs that there was no moderation in pricing pressures in most other areas.

Prices of core goods rose 0.3 per cent over the month, with the annual inflation rate remaining constant at 6.9 per cent rather than dropping to 6.8 per cent, as economists expected.

Worse news for the BoE was that services prices, which officials see as the best indicator of underlying domestic inflation, rose 0.8 per cent in July. The annual rate of services inflation increased from 7.2 per cent in June to 7.4 per cent in July, the highest rate since March 1992.

Economists said this would worry policymakers because it showed the fast pace of price rises was a more entrenched domestic problem, rather than the unavoidable consequence of higher wholesale gas and electricity costs.

Paula Bejarano Carbo, associate economist at the National Institute of Economic and Social Research, said: “We have yet to see a turning point in the underlying rate of inflation, which remains stagnant at around 7 per cent.”

-

dutchman - Site Admin

- Posts: 50566

- Joined: Fri Oct 23, 2009 1:24 am

- Location: Spon End

Re: UK inflation rises to highest level in almost 30 years at 5.4%

UK inflation unexpectedly holds steady at 6.7% amid rising fuel prices

UK inflation unexpectedly held steady in September at 6.7% as soaring fuel costs offset the first monthly fall in food prices for two years to maintain pressure on households amid the cost of living crisis.

The Office for National Statistics said the annual inflation rate as measured by the consumer prices index remained unchanged from August’s reading, raising questions over the Bank of England’s next decision on interest rates in November. City economists had forecast a modest fall to 6.6%.

Food and non-alcoholic drink prices fell by 0.2% on the month – the first monthly decline since September 2021 – helped by fierce competition among supermarkets driving down prices for milk, cheese and eggs, as well as mineral water, soft drinks and juices.

However, prices remain significantly higher than a year ago, with the cost of an average food shop still up by more than 12% on an annual basis.

Concerns over the fallout from the Israel-Hamas conflict have pushed up the price of oil in recent days, raising the prospect of prolonged high prices for consumers at the pump.

September’s inflation rate is normally used by the government to increase the value of benefits the following April. However, Rishi Sunak has so far refused to commit amid speculation he was considering a below-inflation rise as the government grapples with tight public finances.

-

dutchman - Site Admin

- Posts: 50566

- Joined: Fri Oct 23, 2009 1:24 am

- Location: Spon End

Re: UK inflation rises to highest level in almost 30 years at 5.4%

Inflation slows to 4.6% as government says pledge met

UK inflation fell sharply in October to its lowest rate in two years, largely due to lower energy prices.

Inflation, which measures the rate at which consumer prices rise, dropped to 4.6% in the year to October, down from 6.7% the month before.

The government says its pledge to halve inflation by end of the year has been met early.

But there is a limit to how much credit ministers can take for the fall as energy prices settle.

Economists have said the main reason inflation has fallen from its peak of 11.1% in October 2022 is due to a fall this month in the energy price cap, which limits what suppliers can charge consumers per unit of energy.

They also note the Bank of England's decision to raise interest rates, in a bid to cool demand in the UK economy and slow price rises.

Rates are currently at 5.25%, a 15-year high, which has pushed up mortgage costs but also led to higher savings rates.

Although the signs point to the cost of living easing, many households will not feel better off, especially when it comes to energy bills.

Despite gas and electricity prices being lower than last year, most households will actually pay more for energy this winter than last because government support for bills is no longer in place.

Falling inflation also does not mean that most goods and services are cheaper to buy, rather that prices are rising less quickly.

James Smith, research director at the Resolution Foundation think tank which focuses on the living standards of people on low-to-middle incomes, said "the cost-of-living crisis is far from over".

"The scale of Britain's inflation shock has left a legacy of far higher prices," he said.

"Over the past two years, the cost of energy has surged by 49% while food prices have risen by 28% - far greater than the 14% in average earnings over this period."

When Rishi Sunak pledged in January to halve inflation by the end of the year, many experts were already forecasting the rate would drop.

Responding to the latest figures, the prime minister said the pledge had been his "top priority" and required "hard decisions and fiscal discipline".

But the IFS's Mr Johnson called the pledge "opportunistic" given inflation was expected to fall anyway.

The ONS said that energy and food prices were still above where they were two years ago. It is also possible that the energy price cap for next year, which is unveiled next week, could show energy prices are set to rise again.

-

dutchman - Site Admin

- Posts: 50566

- Joined: Fri Oct 23, 2009 1:24 am

- Location: Spon End

Re: UK inflation rises to highest level in almost 30 years at 5.4%

What does this whining muppet think he's being paid for? Plus, he's just undermined Sunak's ridiculous claim that he was responsible for the recent reduction in the inflation figures with his fiscal policies!

Source: https://www.reuters.com/markets/europe/boes-bailey-says-getting-inflation-2-will-be-hard-work-2023-11-27/

BoE's Bailey says getting inflation to 2% will be 'hard work'

Bank of England Governor Andrew Bailey said getting inflation down to the central bank's 2% target will be "hard work" as most of its recent fall was due to the unwinding of the jump in energy costs last year.

"The rest of it has to be done by policy and monetary policy," Bailey said in an interview with website ChronicleLive published on Monday.

"And policy is operating in what I call a restrictive way at the moment - it is restricting the economy. The second half, from there to two, is hard work and obviously we don't want to see any more damage."

The BoE kept rates on hold for a second consecutive meeting earlier this month after 14 increases in a row to fight an inflation rate that peaked above 11% just over a year ago before falling to 4.6% in October.

The BoE's latest forecasts show it expects inflation to return to 2% only at the end of 2025.

Bailey acknowledged the impact of higher interest rates on households caused by higher mortgages and rents. But he repeated his message that it was too soon for the BoE to think about cutting interest rates.

"I'm very conscious of the position of the less well-off," he told ChronicleLive.

"But we do have to get (inflation) down to 2% and that's why I have pushed back of late against assumptions that we're talking about cutting interest rates or we will be cutting interest in anything like the foreseeable future because it's too soon to have that discussion."

Financial markets are currently fully pricing a first rate cut by the BoE in September next year.

Source: https://www.reuters.com/markets/europe/boes-bailey-says-getting-inflation-2-will-be-hard-work-2023-11-27/

Take that Sunak!...most of its recent fall was due to the unwinding of the jump in energy costs last year.

Of course it'll fit; you just need a bigger hammer.

-

rebbonk - Posts: 65889

- Joined: Thu Nov 12, 2009 7:01 am

Re: UK inflation rises to highest level in almost 30 years at 5.4%

It's a statistical anomaly.

The energy subsidy was never included in the inflation index. If it had been the figure would have been much lower to begin with and the fall much less dramatic.

It would also have created less pressure for wage rises and the government would not have had to increase benefits as much.

The energy subsidy was never included in the inflation index. If it had been the figure would have been much lower to begin with and the fall much less dramatic.

It would also have created less pressure for wage rises and the government would not have had to increase benefits as much.

-

dutchman - Site Admin

- Posts: 50566

- Joined: Fri Oct 23, 2009 1:24 am

- Location: Spon End

Re: UK inflation rises to highest level in almost 30 years at 5.4%

UK inflation falls to 3.9% in November

UK inflation slowed sharply in November to 3.9 per cent, triggering a slide in the pound, a stock market rally and increased expectations of an interest-rate cut early next year.

Wednesday’s number was well below the 4.4 per cent year-on-year increase in consumer prices predicted by economists in a Reuters poll, as inflation was tugged lower by petrol, food and leisure.

The 3.9 per cent figure was also the lowest inflation rate since September 2021, according to the Office for National Statistics data, fuelling speculation about when the Bank of England will reduce interest rates from their 15-year high.

The November data — the first time food inflation has been in single digits since June 2022 — will bolster Prime Minister Rishi Sunak, who has vowed to bring prices under control ahead of the election expected next year.

Samuel Tombs, economist at the consultancy Pantheon Macroeconomics, said the “surprisingly sharp fall” in consumer price inflation made it more likely that the BoE would cut rates in the first half of 2024, “far earlier than it has been prepared to signal so far”.

Tombs added that consumer price inflation now looked set to fall “far more quickly” than the BoE’s Monetary Policy Committee predicted last month.

Core inflation, which excludes energy and food prices, was 5.1 per cent in the year to November, compared with 5.7 per cent in the previous month, the ONS said. That was also comfortably below economists’ forecasts.

-

dutchman - Site Admin

- Posts: 50566

- Joined: Fri Oct 23, 2009 1:24 am

- Location: Spon End

Re: UK inflation rises to highest level in almost 30 years at 5.4%

Someone in the pub last night was telling me just how good this news was. He was a bit miffed when I explained that prices were still rising, just not quite as fast!

Sadly, a lot of people are not very numerate.

Sadly, a lot of people are not very numerate.

Of course it'll fit; you just need a bigger hammer.

-

rebbonk - Posts: 65889

- Joined: Thu Nov 12, 2009 7:01 am

Re: UK inflation rises to highest level in almost 30 years at 5.4%

The figures don't stand up to closer scrutiny. Housing costs for example show a month-on-month fall in November. Not a fall in the rate at which they are increasing but a fall in the actual prices people pay.

The weighting of the overall inflation figure has also been adjusted to give more prominence the supposed 'fall' in housing costs than they had in previous months. How convenient!

The weighting of the overall inflation figure has also been adjusted to give more prominence the supposed 'fall' in housing costs than they had in previous months. How convenient!

-

dutchman - Site Admin

- Posts: 50566

- Joined: Fri Oct 23, 2009 1:24 am

- Location: Spon End

Who is online

Users browsing this forum: No registered users and 23 guests

-

- Ads