UK households have amassed an additional £180bn in bank accounts, estimates show

Britons are preparing to splash the cash. Starved of frivolous shopping and many forms of fun during coronavirus lockdowns, they are on course to have amassed an extra £180bn in their bank accounts, equivalent to almost 10 per cent of the UK’s annual gross domestic product.

With non-essential shops and services including hairdressers and gyms due to welcome back customers on Monday after a third lockdown in England, and pubs and restaurants also set to reopen their outdoor tables, economists and investors are trying to figure out how much of that cash will be spent.

The consensus is the easing of coronavirus restrictions will spark a surge in consumer spending, at least by wealthier households. But whether that triggers a lasting US-style Roaring Twenties frenzy of consumption, or a more shortlived summer of fun, is a subject of intense debate.

“There is disagreement in the economist community over whether or not savings will get spent,” said Karen Ward, chief market strategist for JPMorgan Asset Management. “I just think it will get spent.”

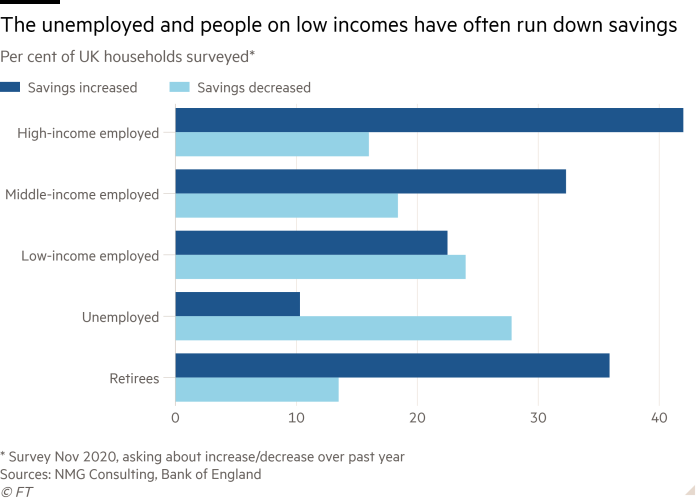

The main case against a surge in consumer spending is that poorer households have not enjoyed the same accumulation in savings, and they are normally more responsive to changes in their financial conditions than the rich.

A BoE survey last year showed that unemployed people drained savings during lockdowns to make ends meet, while low-income households were roughly evenly split between those that have increased the money in their bank accounts and others that have run down their cash reserves. Wealthier households, by contrast, saved a much larger amount of their income.

One key reason economists and investors are uncertain on how Britons will respond to their new-found freedoms is the fear factor: some may be reluctant to spend partly because the government’s advisers have warned the world will be living with coronavirus for the foreseeable future.

Fabrice Montagné, chief UK economist at Barclays, said Britons will show “no urge to splurge”.

“We are likely to see one, two, three months of people really enjoying the summer, and a bump in credit card spending, but that does not mean people are going to spend 10 per cent of GDP in restaurants,” he added.

"Britons prepare to spend their savings as lockdown eases"

1 post

• Page 1 of 1

"Britons prepare to spend their savings as lockdown eases"

-

dutchman - Site Admin

- Posts: 50467

- Joined: Fri Oct 23, 2009 1:24 am

- Location: Spon End

1 post

• Page 1 of 1

Who is online

Users browsing this forum: No registered users and 5 guests

-

- Ads